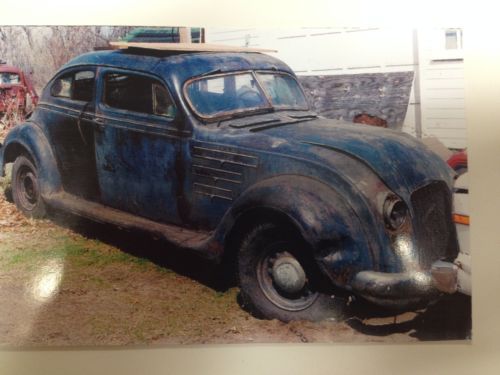

Rare 1934 Chrysler Imperial Airflow Model Cv 5 Passenger Coupe W Parts Art Deco on 2040-cars

Saint Cloud, Minnesota, United States

Chrysler 200 Series for Sale

2007 chrysler 300 leather cruise ctrl alloy wheels 20k texas direct auto(US $14,980.00)

2007 chrysler 300 leather cruise ctrl alloy wheels 20k texas direct auto(US $14,980.00) 2008 chrysler pt cruiser automatic cd audio only 60k mi texas direct auto(US $8,980.00)

2008 chrysler pt cruiser automatic cd audio only 60k mi texas direct auto(US $8,980.00) Htd leather power hard top touch screen phone warranty net direct autos texas(US $24,988.00)

Htd leather power hard top touch screen phone warranty net direct autos texas(US $24,988.00) 2013 chrysler 300 auto heated leather alloy wheels 6k!! texas direct auto(US $27,480.00)

2013 chrysler 300 auto heated leather alloy wheels 6k!! texas direct auto(US $27,480.00) 1998 chrysler sebring convertible limited

1998 chrysler sebring convertible limited 2006 chrysler 300 touring

2006 chrysler 300 touring

Auto Services in Minnesota

Victory Auto Service & Glass ★★★★★

Ultimate Car Care ★★★★★

Tom Kadlec Honda ★★★★★

Svs Inc ★★★★★

Sherlox ★★★★★

Plush Used Cars & Towing ★★★★★

Auto blog

Chrysler nets $1.6B income in Q4, Fiat profit up 5%

Wed, 29 Jan 2014Chrysler announced its 2013 financial results today and unveiled its new name and decidedly bank-like logo. Amid the announcement, Chrysler posted big gains in income, while Fiat didn't perform to analysts' expectations.

For 2013, Chrysler had revenue of $72.1 billion, up 10 percent from 2012. Net income reached $2.8 billion, a 65-percent increase. It was the company's third straight year of annual profits.

In terms of unit sales, Chrysler sold 2.4 million cars worldwide in 2013, up 9 percent. According to Automotive News, 1.8 million of those vehicles were sold in the US, a 14-percent increase. The sales growth boosted Chrysler's US market share to 11.4 percent, up 0.2 percent.

180,000 new vehicles are sitting, derailed by lack of transport trains

Wed, 21 May 2014If you're planning on buying a new car in the next month or so, you might want to pick from what's on the lot, because there could be a long wait for new vehicles from the factory. Locomotives continue to be in short supply in North America, and that's causing major delays for automakers trying to move assembled cars.

According to The Detroit News, there are about 180,000 new vehicles waiting to be transported by rail in North America at the moment. In a normal year, it would be about 69,000. The complications have been industry-wide. Toyota, General Motors, Honda and Ford all reported experiencing some delays, and Chrysler recently had hundreds of minivans sitting on the Detroit waterfront waiting to be shipped out.

The problem is twofold for automakers. First, the fracking boom in the Bakken oil field in the Plains and Canada is monopolizing many locomotives. Second, the long, harsh winter is still causing major delays in freight train travel. The bad weather forced trains to slow down and carry less weight, which caused a backup of goods to transport. The auto companies resorted to moving some vehicles by truck, which was a less efficient but necessary option.

Fiat to list on New York Stock Exchange?

Mon, 06 Jan 2014Citing the ever-nebulous "two sources close to Fiat," Reuters is reporting that the Italian automaker and owner of the Chrysler brand is likely to list itself on the New York Stock Exchange. The move could reportedly happen as soon as 2015, marking the end, at least in the minds of investors, of Fiat's 115-year base in Turin, Italy.

The Italian government is not likely to react favorably to Fiat's potential move from Italy to the United States, despite initially positive reactions to Fiat's landmark final purchase of Chrysler, the third-largest automaker in the US. Fiat spent $3.65 billion to buy out the 41.46-percent stake in Chrysler that had been owned by the United Auto Workers' VEBA trust fund.

With little sign of a swift European recovery, Fiat has little choice but to focus on markets outside its traditional home, and a listing in New York could potentially be a boon for investors. According to International Strategy and Investment analyst George Galliers, speaking to Reuters, "People [would be] more likely to think of the entity in the same context as they do Ford and GM" if it were listed on the NYSE.