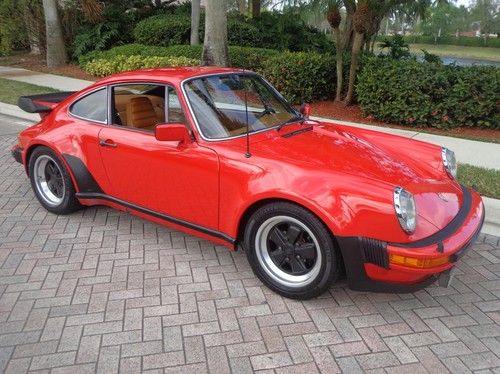

1986 Porsche 930 Turbo Slantnose 4 Speed Just 12k+ Miles Rare Collector Car on 2040-cars

La Jolla, California, United States

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Manual

Make: Porsche

Warranty: Unspecified

Model: 930

Mileage: 12,426

Options: Leather

Sub Model: Slantnose

Exterior Color: Black

Interior Color: Cashmere

Doors: 2 doors

Number of Cylinders: 6

Engine Description: 3.3L H6 FI Turbo

Porsche 930 for Sale

1986 porsche 930 carrera turbo coupe white classic whale tail great buy(US $49,000.00)

1986 porsche 930 carrera turbo coupe white classic whale tail great buy(US $49,000.00) 1985 porsche 911 turbo 930 euro edition(US $38,500.00)

1985 porsche 911 turbo 930 euro edition(US $38,500.00) Mint condition 1986 porsche 930 turbo(US $43,000.00)

Mint condition 1986 porsche 930 turbo(US $43,000.00) 1979 porsche 930 turbo coupe(US $85,000.00)

1979 porsche 930 turbo coupe(US $85,000.00) Porsche turbo

Porsche turbo Triple blue, 1800 miles on fully documented mechanical restoration! 2 owner car!(US $55,000.00)

Triple blue, 1800 miles on fully documented mechanical restoration! 2 owner car!(US $55,000.00)

Auto Services in California

Xtreme Auto Sound ★★★★★

Woodard`s Automotive ★★★★★

Window Tinting A Plus ★★★★★

Wickoff Racing ★★★★★

West Coast Auto Sales ★★★★★

Wescott`s Auto Wrecking & Truck Parts ★★★★★

Auto blog

Porsche again staring down another $1.8B in hedge fund lawsuits

Wed, 15 May 2013The sequence of events from 2007 that began with Porsche's secret attempt to take over Volkswagen, and instead lead to Porsche being taken over by VW, continues to instigate lawsuits against the Stuttgart sports car manufacturer. A group of hedge funds that suffered over $1 billion in losses sued the car company in New York. Porsche had publicly stated it wasn't trying to buy VW, the hedge funds in question were shorting VW stock, and when Porsche's actual intentions were revealed, the stock shot up and the hedge funds took a beating.

The case was thrown out over the issue of jurisdiction, then appealed, only to see another suit filed on top of that. After that, most of the hedge funds withdrew their claims in New York and Porsche offered a 90-day window to refile in Germany where it is already fighting a number of other suits over the same issue. The hedge funds accepted the offer, refiling in Stuttgart for $1.8 billion in damages. According to Bloomberg, Porsche hasn't commented on the refiling, but as the same plaintiffs are involved, it's safe to assume that the carmaker still feels the case is "unsubstantiated and without merit." It has fared alright so far even in German courts, with two lesser cases against it thrown out last year.

Porsche's former CEO Wiedeking to stand trial over VW-share manipulation

Wed, 27 Aug 2014Former Porsche CEO Wendelin Wiedeking (left in the above photo) could potentially be facing some time in the slammer after all. The last we had heard, he and former Chief Financial Officer Holger Haerter (right) had avoided a trial in April due to a lack of evidence. However, an appeals court in Stuttgart has looked at the case again and overruled the earlier decision, finding that the executives should be tried for share manipulation during Porsche's failed attempt to take over Volkswagen in 2008, Bloomberg reports.

The judges in the appeal "list numerous indications that could suggest that there was a hidden decision to increase the stake as they could suggest the opposite evaluation by the lower court," said Stefan Schueler, a spokesperson for the court, in a statement cited by Bloomberg. Wiedeking and Haerter put out their own releases saying that there was no merit to the charges.

The prosecutors allege that Wiedeking and Haerter had a plan to buy up VW stock options in 2008 to take the automotive giant over but hid it from investors. The whole thing was a massive failure and eventually allowed VW the chance to acquire Porsche and forced the two execs to step down. In addition to the criminal investigation, hedge funds have attempted to sue the company multiple times in civil court for the same reason, but they have repeatedly failed.

Porsche Australia price cuts in excess of $36,000 irks customers

Tue, 04 Jun 2013Have you ever gone to the store, only to become irked after learning that the new [*insert widget here*] that you bought just last week has gone through a price drop? If you're particularly thrifty, even if it's only a couple of bucks, you probably brought in your receipt to see if the store would issue you a credit for the difference. Now, imagine that the widget in question isn't a minor purchase, it's a Porsche - and the price drop isn't just a few bucks - it's thousands.

That's the unhappy scenario that recently faced a number of Australian luxury car buyers and the uncomfortable conversation awaiting the German automaker. According to GoAuto, Porsche Australia recently whacked up to $36,000 off the price of its models in order to jumpstart sales Down Under - the Panamera range itself saw cuts between $5,500 and more than $36,000. The aggressive price cut was a strategy designed to drive sales of more than 3,000 cars locally, a yearly goal originally set for 2018, but now hoped for as early as 2016.

Australia is known for its comparatively high car prices, so the dramatic price cuts were undoubtedly welcome news to potential Porsche shoppers. However, around 50 existing customers were understandably agitated by the reductions because they purchased their cars just before the adjustments took effect. Not only did they stand to lose out on the deals, they also had good reason to fear that their new cars' residual values would take a beating.